Introduction

Bharat Electronics Ltd (BEL) is an Indian government-owned aerospace and defense electronics company. It is a Navratna Public Sector Undertaking (PSU) operating under India’s Ministry of Defence.

Topics of Discussion

Company Profile

BEL specializes in the design, development, and manufacture of advanced electronic products for the Indian Armed Forces and other government organizations. Its extensive product portfolio includes:

Military technology:

Radars, fire control systems, missile systems, sonars, and electronic warfare systems.

Ground and aerospace applications:

Communication products, naval systems, avionics, and tank electronics.

Civilian products:

Telecommunication systems, electronic voting machines (EVMs), and traffic signals.

Location

Headquarters:

BEL’s corporate headquarters is located in Bengaluru, Karnataka.

Manufacturing units:

The company operates several manufacturing units across India, including:

Bengaluru, Karnataka

Chennai, Tamil Nadu

Ghaziabad, Uttar Pradesh

Hyderabad, Telangana

Kotdwara, Uttarakhand

Machilipatnam, Andhra Pradesh

Navi Mumbai, Maharashtra

Panchkula, Haryana

Pune, Maharashtra

Products Manufactured

Bharat Electronics manufactures a broad range of advanced electronic products and systems for India’s defense sector, as well as a growing portfolio of civilian applications

Defense products

The company’s primary focus is on developing and producing sophisticated electronics for the Indian Army, Navy, and Air Force.

Land-based systems

Radars

Weapon Locating Radar (Swathi), Battle Field Surveillance Radar, and the indigenous Indian Doppler Radar (INDRA).

Electronic warfare (EW) systems

A variety of EW and communication jamming systems, including the Samyukta EW System.

Tank and armored vehicle electronics:

Systems for tanks and other armored vehicles, such as tank communication radios and gun upgrades.

Weapon systems and ammunition:

Electronic fuzes, missiles like the Akash air defense system, and precision-guided bombs developed in collaboration with JSR Dynamics.

Command, Control, Communication, Computers, and Intelligence (C4I) systems:

Integrated systems for military applications.

Naval systems

Sonars:

Hull Mounted Sonar Array (HUMSA) and other integrated sonar systems for submarines and ships.

Naval fire control systems:

Including the Lynx-U2 system for naval guns.

Communication systems:

Secure data links and naval communication systems.

Airborne and other defense systems

Avionics

Products like Heads-Up Displays (HUD) for aircraft.

Missile and weapon system components:

Sub-assemblies for missile systems.

Night vision devices:

A wide range of electro-optics, including night vision goggles.

Simulators:

For defense training and operations.

Civilian products

BEL has expanded into several non-defense areas, leveraging its electronics expertise for various civilian and governmental needs.

Government and e-governance

Electronic Voting Machines (EVMs) and Voter Verifiable Paper Audit Trail (VVPAT) systems: Used by the Election Commission of India.

Identity management:

Biometrics capturing devices for national population registration.

Urban and infrastructure

Smart City solutions:

Comprehensive solutions for integrated traffic management, perimeter security, and surveillance.

Homeland security solutions:

Critical Infrastructure Protection Systems that include ground surveillance radars, CCTV, and access control.

Transportation:

Solutions for railways and metros, including automatic fare collection systems.

Traffic management

Electronic traffic signal systems.

Energy and communication

Solar power systems

Solar energy products and systems.

Electric Vehicle (EV) charging stations.

Supporting India’s green energy initiatives.

Telecom and broadcast systems:

Telecommunication terminals and networks for government organizations.

Healthcare

Medical electronics:

Portable remote patient monitoring systems, ICU ventilators, and X-ray systems.

Other civilian products

Embedded products:

Indigenous smartphones and point-of-sale devices.

Network and cybersecurity:

Encryptors and other secure communication systems.

SWOT Analysis of Bharat Electronics Ltd

This SWOT analysis provides a snapshot of Bharat Electronics Limited, focusing on its internal strengths and weaknesses, and external opportunities and threats as of October 5, 2025.

Strengths

Strong Financial Performance:

The company has demonstrated impressive financial metrics, including a 31.06% profit growth and 15.60% revenue growth over the past three years.

Healthy Ratios:

Bharat Electronics Limited maintains a strong Return on Equity (ROE) of 26.73% and Return on Capital Employed (ROCE) of 35.69% over the past three years.

Zero Debt Burden:

The company has successfully maintained a debt-free status for the past five years.

Government Backing:

As a Navratna Public Sector Undertaking, The company benefits from the strong backing of the Indian Ministry of Defence, which holds a 51.14% stake.

Robust Order Book & Strategic Initiatives:

The company has secured substantial orders recently, including ₹1,092 crore and ₹712 crore. The company is actively investing in R&D, expanding its manufacturing capabilities, and diversifying its product portfolio.

Key Player in Defense:

The company is a leader in India’s defense electronics sector, collaborating on major projects like the 5th-Gen Fighter Jet program with L&T.

Weaknesses

High Valuation:

The stock is currently trading at a premium valuation, with a high P/E ratio of 54.84 and EV/EBITDA of 37.46.

Quarterly Revenue Decline:

The company experienced a significant Quarter-over-Quarter (QoQ) revenue decline of 50.74% in the quarter ending June 2025.

Opportunities

Growing Indian Defence Sector:

India’s defense sector is expanding rapidly, driven by increased government spending, a focus on self-reliance (Atmanirbhar Bharat), and efforts to modernize the armed forces.

Increasing Defence Exports:

India aims for US$6.02 billion in annual defense exports by 2028-29, creating opportunities for BEL to expand its global market presence.

Strategic Partnerships:

Collaborations like the MoU with Safran Electronics & Defence for a joint venture to manufacture precision-guided weapons can open new avenues.

Technological Advancement:

BEL’s focus on R&D and incorporating new business units for emerging technologies like Electronic Warfare (EW), seekers, cybersecurity, and unmanned systems positions it for future growth.

Threats

Client Concentration:

A significant portion of it’s revenue (over 80%) is derived from the Indian defense sector, making it vulnerable to policy changes or budget allocations.

Competition:

The Indian defense market is becoming increasingly competitive, with the entry of private-sector players and foreign collaborations.

Supply Chain Disruptions:

As a manufacturing company, Bharat Electronics Limited could be affected by disruptions in global supply chains or fluctuations in raw material costs.

Global Defence Spending Trends:

While India’s spending is increasing, global defense spending fluctuations could impact export opportunities.

Valuation Correction:

The stock’s high valuation could be a risk if market sentiment shifts or future performance falls short of expectations.

Fundamental Analysis

Bharat Electronics Limited is a Navratna Public Sector Undertaking under India’s Ministry of Defence, focused on developing electronics solutions for defense and civilian sectors.

Financial Highlights (as of October 3, 2025)

Last Price: ₹412.7

P/E Ratio: 54.81

Earnings Per Share (EPS): ₹7.53

Expected Dividend Yield: 0.58%

Market Capitalization: ₹3.02 trillion

Recent Performance and Orders

BEL’s Q3 FY25 revenue grew by 39% year-over-year to ₹5,771 crore, with a 53% increase in net profit. For FY24, revenue was ₹19,820 crore (up 14% YoY) and net profit was ₹4,020 crore (up 34% YoY).

The company has recently secured orders worth ₹1,092 crore and ₹712 crore. BEL is also involved in partnerships for India’s 5th-Gen Fighter Jet program with L&T and has an MoU with Safran Electronics & Defence for a joint venture.

Key Strengths

Over the past three years, the company has shown strong profit growth of 31.06% and revenue growth of 15.60%. The company has healthy ratios, including a Return on Equity (ROE) of 26.73% and Return on Capital Employed (ROCE) of 35.69%. BEL has no long-term debt and the Government of India holds a 51.14% stake. It is also expanding strategically by incorporating new business units and setting up new factories.

Potential Challenges

A key risk for BEL is client concentration, with over 80% of revenue coming from the Indian defense sector. The stock is also trading at a high valuation with a P/E ratio of 54.81 and EV/EBITDA of 37.46. Input cost variations and supply chain issues are also potential concerns.

Technical Analysis

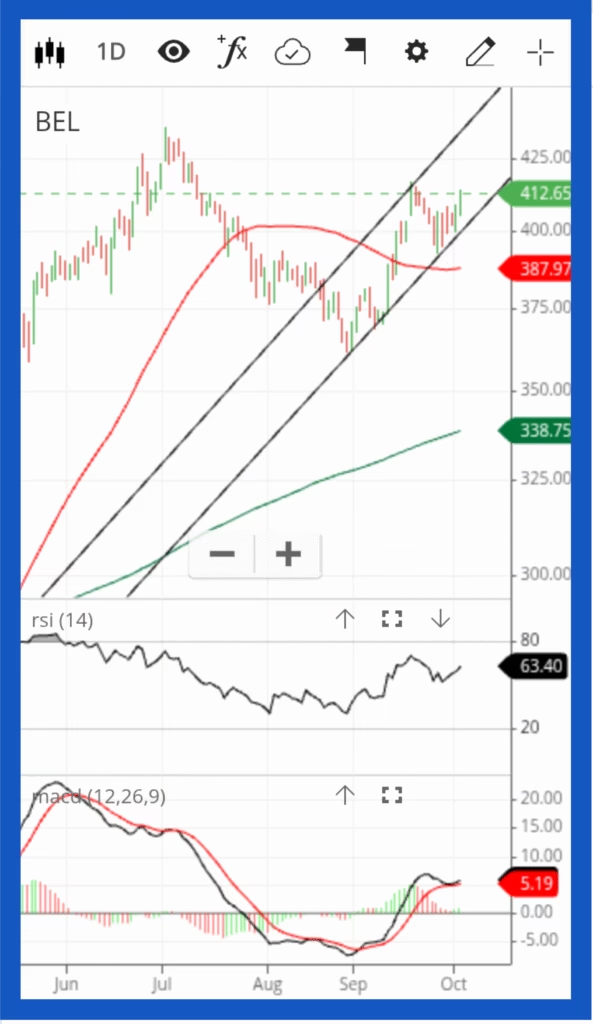

Chart Source : Zerodha Kite

Based on an analysis of its recent price action and technical indicators, Bharat Electronics shows a bullish trend in the short to medium term. The stock is consistently trading above its moving averages, and momentum indicators suggest continued strength.

Analysis of BEL using 50 DMA, 200 DMA, RSI and MACD

The technical analysis of Bharat Electronics (BEL) using the 50-day Moving Average (DMA), 200-day DMA, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) indicates a generally bullish trend with some nuances.

Key Technical Indicators

50-Day Simple Moving Average (SMA):

The price of BEL is currently trading above its 50-day SMA of 388.0. This suggests that the short-term trend is bullish, as the current price of ₹412.7 is significantly higher than this average.

200-Day Simple Moving Average (SMA):

The price is also above its 200-day SMA of 338.75 This reinforces the bullish outlook, indicating a strong long-term trend, as the stock has shown consistent growth from around ₹25 in 2005 to over ₹340 in 2025.

Relative Strength Index (RSI):

The RSI is currently in the mid-range. While a specific value isn’t provided for the latest date, it’s described as mid-range, suggesting balanced momentum without being overbought or oversold. Earlier data showed a 14-day RSI of 63.40 on October 3, 2025, approaching the overbought threshold.

Moving Average Convergence Divergence (MACD):

The provided information indicates that MACD is among the technical indicators available for BEL. However, specific values or signals (e.g., bullish crossover, bearish crossover) for the MACD aren’t detailed in the search results.

Overall Trend and Momentum

Positive Momentum: The stock is trading above both its 50-day and 200-day moving averages, which is a strong bullish signal. This suggests sustained buying interest and upward momentum.

Long-Term Growth:

BEL has demonstrated consistent long-term growth, supported by strong fundamentals like being debt-free, consistent dividend payouts, and government backing. The company has returned over 1,000% in the last 20 years.

Recent Performance: On October 3, 2025, BEL’s share price moved up by 1.52%, closing at ₹412.7. The stock had a daily range between ₹405.1 and ₹413.8.

Analyst Recommendations

Goldman Sachs has a “Buy” rating and a target price of ₹455. Motilal Oswal forecasts a 24% upside potential. Some analysts suggest accumulating the stock in the ₹280-265 range with a target of ₹350.

Buy Recommendations: Several analysts have given “Buy” recommendations for BEL.

One analyst suggests a buy at the current market price of ₹402, with a stop loss at ₹390 and a target of ₹440.

Motilal Oswal maintained a “Buy” rating with a target price of ₹490, implying a 24% upside potential based on expected sales growth of 18% and net profit growth of 17% over FY25-FY28.

Another recommendation suggests a buy at ₹406.50, with a target of ₹432 and a stop-loss of ₹393.

Growth Drivers

Rising Defense Budget and “Make in India”:

Increased government allocation to defense and the “Make in India” initiative significantly benefit BEL.

Order Book:

The company has a robust order book exceeding ₹1 lakh crore, providing revenue visibility for the next 5-7 years. In 2023, the order inflow was over INR 60,000 crores.

Diversification:

Diversification into non-defense markets like smart cities, homeland security, and healthcare is expected to reduce risks and create new revenue streams.

Exports:

BEL aims to enhance its export business, targeting $300 million in sales by the end of 2025.

BEL’s export activities

BEL is actively involved in exporting its products and services globally.

Exports have seen consistent growth: In the fiscal year 2024–2025, BEL’s export sales reached a new high of $106 million, a 14.18% increase from the previous year.

Export products: BEL exports a diverse range of products, including:

Coastal Radar Systems

Electronic Warfare (EW) systems and upgrades

Communication equipment

Modules for missile systems

Solar Hybrid Power Plants

Contract manufacturing services

Major export markets: BEL’s exports reach many countries, including the USA, UK, France, Israel, Sweden, Mauritius, Singapore, and various countries in Africa, Southeast Asia, and Latin America.

Export strategy:

The company has an international marketing presence and collaborates with foreign partners to enhance its geographical reach and explore new markets. BEL is also focusing on exports in the civilian sector, including AI-based applications and solar power solutions.

Risks

Dependency on Government Orders:

A large proportion of BEL’s revenue comes from Indian government orders, making it susceptible to cuts in government expenditure.

Technological Obsolescence:

The rapid pace of technological development requires continuous investment in R&D to remain competitive.

Competition:

Increased private participation in defense production could intensify competition for BEL.

Based on the technical indicators and analyst views, BEL shows positive momentum and strong long-term growth potential, though investors should be mindful of the approaching overbought territory on the RSI and the inherent risks associated with its business model.

Comparison of BEL with its major competitors

Bharat Electronics (BEL) is a leader in the Indian defense electronics sector, but it faces competition from other defense Public Sector Undertakings (PSUs) and private firms

Compared to its major peers, BEL stands out for its strong financial health and stable profitability, while Hindustan Aeronautics Ltd (HAL) has a larger market capitalization and Bharat Dynamics Ltd (BDL) shows strong growth but higher valuation.

Market share

Bharat Electronics (BEL): As a “Navratna” PSU, BEL has a dominant position in India’s defense electronics market, commanding an estimated 37% market share in this segment.

Hindustan Aeronautics Ltd (HAL): HAL is a market leader primarily in the aerospace sector. While it does not directly compete in BEL’s specific electronics niche, its overall market capitalization is larger.

Bharat Dynamics Ltd (BDL): As a major missile systems manufacturer, BDL is a significant competitor. However, its market cap is considerably smaller than BEL’s and HAL’s.

Mazagon Dock Shipbuilders and Garden Reach Shipbuilders & Engineers: These are also significant defense PSUs but specialize in naval shipbuilding, which differs from BEL’s core business in electronics.

Private sector companies: Several private firms are also emerging in the defense sector, including Data Patterns and Zen Technologies, but they currently have much smaller market capitalizations than the large PSUs.

Valuation (as of early October 2025)

BEL: Trading at a Price-to-Earnings (P/E) ratio of approximately 54.8x, BEL is valued slightly below the average for its broader industry peers (around 57x). However, some analyses suggest it is overvalued compared to its estimated fair value.

HAL: With a P/E ratio around 39.47x, HAL appears relatively more attractive from a valuation perspective compared to BEL.

BDL: At a significantly higher P/E ratio of over 100x, BDL trades at a much higher valuation than its PSU counterparts.

Mazagon Dock and Garden Reach Shipbuilders: These companies have P/E ratios in the mid-50s, similar to BEL’s.

Financial strength

BEL: Demonstrates superior financial health, which is a key advantage over many competitors.

Debt-free status: The company is virtually debt-free and has strong cash flow management.

High profitability: BEL operates with high-profit margins due to its focus on high-margin defense electronics.

Robust profitability metrics: It consistently delivers a strong Return on Equity (ROE), though it may lag some competitors in Return on Capital Employed (ROCE).

HAL: Also has very strong financial fundamentals.

Debt-free: Like BEL, HAL also has an almost debt-free balance sheet.

Consistent growth: It has delivered strong profit growth and has a healthy dividend payout record.

BDL: While its ROE of 13.71% is strong, it lags behind BEL’s and HAL’s higher returns.

Bharat Forge: In contrast to the debt-free defense PSUs, Bharat Forge carries a higher debt-to-equity ratio of 0.72. Its ROE is also lower at around 11%.

Factors Affecting BEL

Government Policies:

BEL’s performance is heavily influenced by Indian government policies, as over 80% of its revenue comes from the Indian defense sector. Initiatives like the “Make in India” and “Aatmanirbhar Bharat” (Self-Reliant India) campaigns, along with a positive indigenization list for defense equipment, provide a strong push for BEL to secure major domestic contracts. The annual allocation for the Ministry of Defence directly impacts BEL’s funding and order pipeline.

Institutional Activity and Market Sentiment:

Major orders and news headlines heavily influence market sentiment and institutional activity around BEL. When the company announces new contracts, such as the ₹1,092 crore order in September 2025, its stock typically rallies. Institutional investors like Goldman Sachs have a significant effect; its “Buy” rating in October 2025 caused BEL’s stock to rise. However, BEL’s valuation, considered “very expensive” by some metrics, presents a risk that can lead to negative sentiment shifts.

Sector Trends:

The defense electronics sector is seeing a global trend toward modernization and self-reliance, which directly benefits BEL. The Indian government’s focus on upgrading its defense capabilities, including electronic warfare (EW) systems and communication networks, ensures a steady demand for BEL’s products. A shift toward system integration from basic manufacturing also favors BEL, which is positioning itself as a system integrator for complex missile systems like QRSAM.

Geopolitical Events:

Tensions between nations, as seen between Israel and Iran in mid-2025, can spur investor interest in defense stocks like BEL, as governments globally prioritize military readiness.

Technological Advancements

While BEL invests heavily in R&D, the rapid pace of technological innovation, particularly in areas like 5G, artificial intelligence (AI), and semiconductor technology, presents both an opportunity and a risk. BEL must continue to innovate to remain competitive against both domestic and global players.

Infrastructure demand :

Infrastructure demand: BEL’s products have applications beyond the defense sector. The company’s expansion into non-defense areas like “smart cities,” solar power generation, and public infrastructure creates additional avenues for growth. For example, the government’s push for “smart cities” and rural electrification creates demand for electronics like solar panels, batteries, and telecommunications equipment, which BEL is positioned to supply.

Global impact:

BEL’s expansion into international markets is aimed at broadening its customer base and increasing export sales. The company’s products are exported to numerous countries across continents, including Europe, Southeast Asia, Africa, and North and Latin America.

Offset obligations:

BEL works with major foreign Original Equipment Manufacturers (OEMs) to meet their offset obligations required for defense contracts with India. This collaboration helps BEL gain access to foreign technology and integrate its products into global supply chains.

RVNL Multibagger Potential 2025: Full SWOT, Investor Outlook & Growth Triggers Explained

Complete RVNL 2025 multibagger analysis — fundamentals, technicals, SWOT, investor views, competition, and policy trends shaping its growth story.

Read More →Why KEI Industries Could Be a Strong Buy for 2025 and Beyond

Comprehensive look at KEI Industries: SWOT, fundamental analysis (revenue, profitability, debt, ratios, valuation), technical analysis, institutional view, growth drivers, risks and competitor comparison.

Read More →