Introduction

Technical indicators play a crucial role in understanding market direction, momentum, and potential reversal points. Whether you are analyzing the Nifty 50 Index or individual stocks, knowing how to interpret tools like the Elder Impulse System, Ichimoku Cloud, Parabolic SAR (PULSar), Heikin Ashi, and Supertrend can significantly improve your decision-making.

This brief guide explains the core signals of each indicator, helping you follow our Nifty 50 predictions more confidently and with better clarity.

Topics of Discussion

Elder Impulse System

Developed by Dr. Alexander Elder, the Elder Impulse System integrates trend and momentum by combining the 13-period Exponential Moving Average (EMA) with the MACD Histogram. Price bars are color-coded to reflect the prevailing market condition:

Green Bars:

Both the 13-day EMA and MACD Histogram are rising, indicating strengthening bullish momentum. This environment typically favors initiating or maintaining long positions.

Red Bars:

Both components are declining, signaling bearish momentum. Traders may consider exiting long positions, initiating short trades, or adopting a defensive stance.

Blue/Neutral Bars:

Mixed momentum or consolidation is present, suggesting a lack of clear direction. During such periods, waiting for confirmation in the broader trend is generally advisable.

Ichimoku Cloud

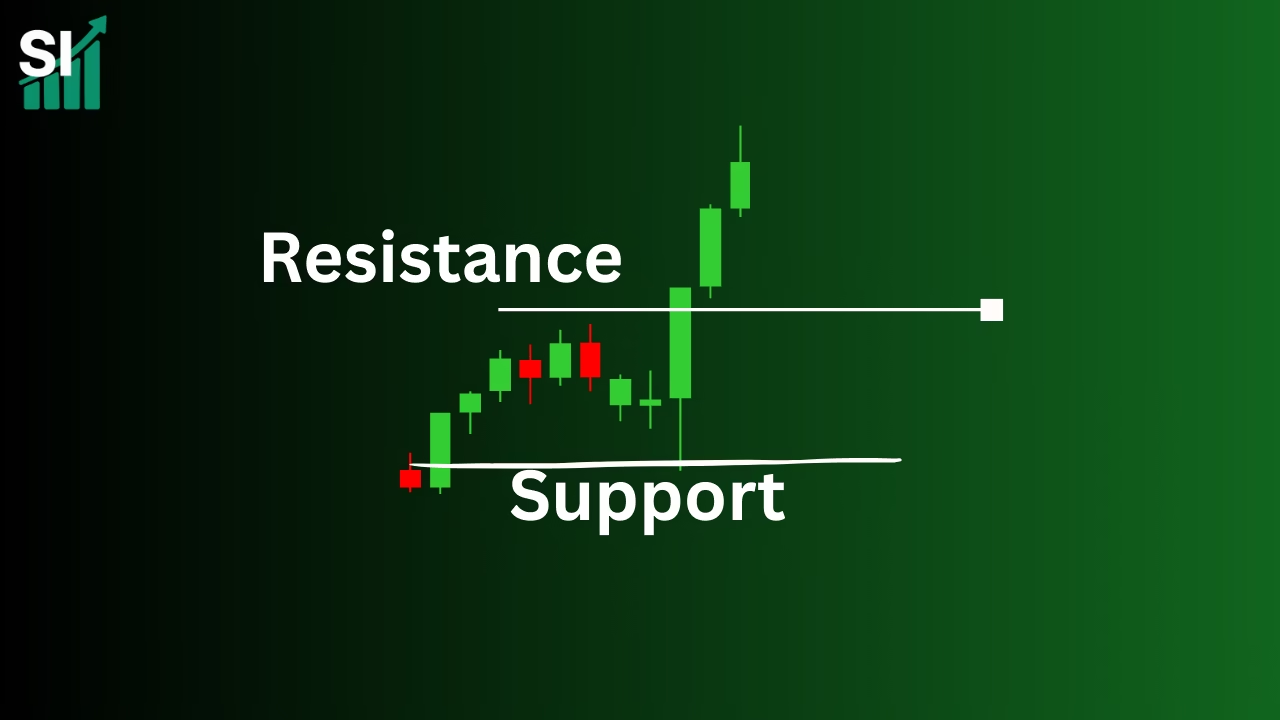

The Ichimoku Cloud (Ichimoku Kinko Hyo) offers a comprehensive view of trend direction, momentum, and key levels of support and resistance.

Key interpretations:

Price above the Cloud:

Indicates a bullish environment, with the Cloud acting as a support zone.

Price below the Cloud:

Reflects bearish conditions, where the Cloud serves as resistance.

Price within the Cloud:

Suggests indecision or consolidation, often signaling a range-bound market.

Additional insights:

A green Cloud (Leading Span A above Leading Span B) supports an uptrend, whereas a red Cloud indicates a downtrend.

A thicker Cloud represents stronger support or resistance.

A bullish crossover of the Conversion Line (Tenkan-sen) above the Base Line (Kijun-sen), especially above the Cloud, strengthens bullish conviction.

A bearish crossover below the Cloud reinforces downside momentum.

The Lagging Span (Chikou Span) above price confirms bullish sentiment, while remaining below price validates a bearish outlook.

Parabolic SAR (PULSar)

The Parabolic Stop and Reverse (SAR) indicator identifies trend direction and potential reversal points through a series of plotted dots:

Dots below price: Bullish trend continuation.

Dots above price: Bearish trend continuation.

Dot reversal (switching sides): Potential trend reversal, often used for trailing stop adjustments or exit timing.

Heikin Ashi

Heikin Ashi candlesticks smooth price fluctuations, helping traders identify trend strength more clearly.

Interpretation includes:

Long green candles without lower wicks: Strong, sustained uptrend.

Long red candles without upper wicks: Strong, persistent downtrend.

Small bodies with wicks on both sides: Market indecision and potential reversal signals.

Supertrend

The Supertrend indicator, based on the Average True Range (ATR), provides clear buy and sell signals while functioning as a dynamic trailing stop.

Buy signal: Indicator line shifts below price and turns green.

Sell signal: Indicator line shifts above price and turns red.

The Supertrend line also serves as a trailing stop-loss, adjusting with price movements to help lock in profits.

Conclusion

Understanding these unconventional technical indicators provides a deeper perspective on market behavior beyond simple moving averages or price patterns. When applied together, they help identify trend strength, momentum shifts, and potential reversal zones with higher confidence.

By using these tools alongside our Nifty 50 Prediction analysis, readers can interpret market movements more accurately and make more informed trading decisions.

Summary at a Glance

Elder Impulse System

Identifies the alignment of trend and momentum through color-coded bars.

Ichimoku Cloud

Shows trend direction, support/resistance zones, and momentum strength in one view.

Parabolic SAR (PULSar)

Highlights trend direction and potential reversal points using trailing dots.

Heikin Ashi

Smooths price action to reveal clearer trend strength and transition phases.

Supertrend

Provides straightforward buy/sell signals and acts as a dynamic trailing stop-loss.