The primary purpose of a Systematic Investment Plan (SIP) is to lower the average buying cost of a stock or mutual fund over time. To achieve this, an investor needs to commit a fixed amount regularly—typically every month—into a chosen stock or mutual fund for at least five years.

However, this can be challenging for individuals who want to invest with irregular income. Do irregular investment work. One practical solution is to invest a modest, affordable amount consistently, while keeping any surplus funds reserved in a bank account. But this approach raises further questions: What if an emergency arises and you can’t maintain the fixed contribution every month? What happens if you over-invest and later need immediate funds? Even salaried individuals receive annual bonuses—should this lump sum sit idle in a savings account, earning negligible returns?

Idle money in a bank account presents an opportunity cost. So, how can you deploy this surplus safely and effectively? If needed, how much can you withdraw without disrupting the compounding growth of your investments ?

As the saying goes, “Consistency beats all other forms of discipline.” The key, therefore, is to remain a disciplined investor—even if the investment amount varies each month. If you miss a contribution one month, catch up in the next. The ultimate goal of an SIP is to steadily build a substantial corpus with minimal risk.

Table of Contents

How irregular investment work like a Sip

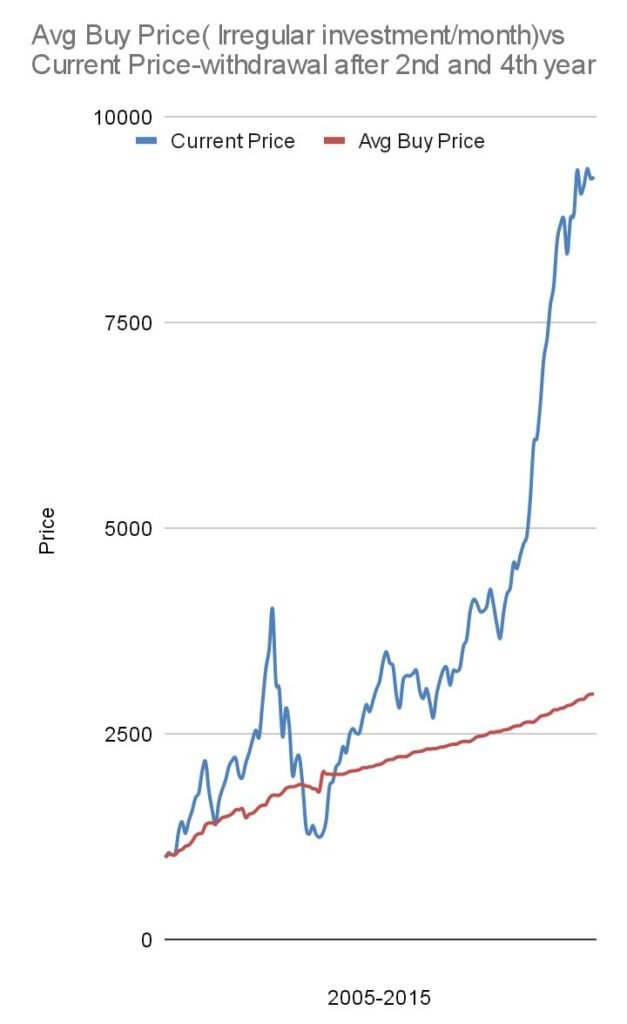

To illustrate this flexible approach, let’s analyze how a variable monthly investment—ranging from ₹0 to ₹12,000—performs when invested in the Nifty Midcap 150 Momentum 50 Index. This example demonstrates how staying consistent, even with fluctuating amounts, can help you build significant wealth over time while accommodating real-life income variations and unexpected expenses.

Irregular investment functions in a manner similar to a regular monthly SIP; however, the key difference is that the red line representing the average buying price is not smooth but appears wavy.

Key inferences of irregular investment

1. Consistent investing for a long period of time is the key to succeed in making profit in share market/ Mutual fund.

2. It is not necessary to invest a fixed ammount every month but investing some ammount every month is important.

3. In long run, this system acts similar to regular monthly SIP

4. Advantage of this system is there lies no idle money in the bank account.

5. The system of irregular investment is just like a flexible recurring account with very high interest rate.

Conclusion

If a person wants to invest with irregular income, the best approach is to invest whenever there is surplus money available. During times of need, it’s acceptable to withdraw a portion of the irregular investment. However, the most important aspect is building the habit of consistent investing. Stay committed to the process and avoid giving up—continuity is key to achieving long-term financial goals.

Disclaimer:

“This article is for educational purposes only. Read our full disclaimer .”