Introduction

I always knew that money grows through compounding—provided one invests in the right stocks or mutual funds. However, like many beginners, I was confused about how to select the right investing strategy. Ignoring this confusion, I embarked on my investment journey by opening a Demat and trading account with Zerodha, one of India’s leading brokerage platforms.Whenever I saved money, I would invest in different large-cap stocks. I didn’t invest blindly; I made it a point to check the fundamentals and apply technical analysis before buying. Despite this, I held my stocks for only 2–3 months, and each time, I exited with a loss, often at my stop-loss limit.I tried again with a new set of stocks—same result: loss. Transaction costs imposed by NSE and CDSL also ate into my returns. A whole year passed like this, with no profitable trades to show. Frustrated and disheartened, I finally sold all my stocks and told myself:”I’m not lucky enough to be the next Warren Buffett.”Still, I didn’t understand why I kept failing.In a moment of frustration—but also with hope—I invested my entire remaining capital into two mutual funds:

- Parag Parikh ELSS Tax Saver Fund

- Quant ELSS Tax Saver Fund

For those unfamiliar, ELSS (Equity Linked Saving Scheme) funds are flexi-cap mutual funds with a 3-year lock-in period. I could not touch the investment during this time, but I kept investing my monthly savings into these funds consistently.

Table of Contents

The Turnaround – Investing strategy worked

After 1.5 years, I noticed something incredible—all my losses were recovered. After 2.5 years, I was in substantial profit.

This made me wonder:

“What investing strategy do mutual fund managers know that I don’t?”

That question became a turning point. I promised myself to unlock the mystry of investing. I started reading books, attending seminars, and diving into research. But I still didn’t find complete clarity—so I began my own research, focusing on two vital questions:

Investing strategy 1-How to avoid loss in investing –

A wise saying goes:> “Never quit. Learn from failure, and restart with a new approach.”Here’s what I learned from my initial losses:

Key Lessons on Investing Strategy:

- Investing is not for short-term gains.Whether it’s stocks or mutual funds, you need to stay invested for at least 3 years—ideally 5+ years—for meaningful returns.

- Portfolio diversification means more than just 10–12 stocks.A well-diversified equity portfolio should have at least 25 stocks to manage sector and company-specific risks.

- Frequent switching kills returns.Jumping from one stock (or MF) to another, especially based on short-term performance, is a recipe for underperformance. Patience and conviction are essential.

Conclusion:

The key to minimizing losses is long-term holding and consistent investing, like a Flexible SIP, regardless of market ups and downs.

Investing Strategy 2 – How to Maximize Profit in Investing

Let’s take some inspiration from Buffett.Between 1965 and 2023, Berkshire Hathaway delivered a 19.8% CAGR—nearly double the S&P 500’s 10.2%. However, in the last 10 years, even Buffett’s returns were closer to 12% CAGR, matching the index.

This tells us that achieving 18–20% CAGR is exceptional but possible with the right strategies.

Investing Strategy to Achieve High Returns:

1.Invedting strategy:Choose Midcap Stocks or Midcap Mutual Funds

Think of midcaps like young athletes—mature enough to perform, yet full of potential. Small caps are often unstable. Large caps have already matured, limiting growth. Midcaps strike the perfect balance.

Historical data shows that the Nifty Midcap 150 has outperformed both Nifty 50 and Nifty Smallcap 250 since 2005.

2.Investing Strategy -Prefer Passive Funds Over Active Funds

According to the Economic Times, over the last 5 years, only 14–21% of actively managed equity funds outperformed their benchmarks. Over 10 years, less than 10% did.

This investing strategy shows that it’s smarter to choose passive index funds for the long term.

3. Investing Strategy-Use Strategic Index Funds (Factor-Based Investing)

Strategic indices are created by selecting stocks from the benchmark index based on quantitative rules. Examples include:

- Nifty Midcap 150 Momentum 50

- Nifty 200 Momentum 30

- Nifty Alpha 50

- Nifty Smallcap 250 Quality Momentum 100

- and others

These indices often outperform broad-based indices due to:

Rule-based, bias-free stock selection and consistent rebalancing

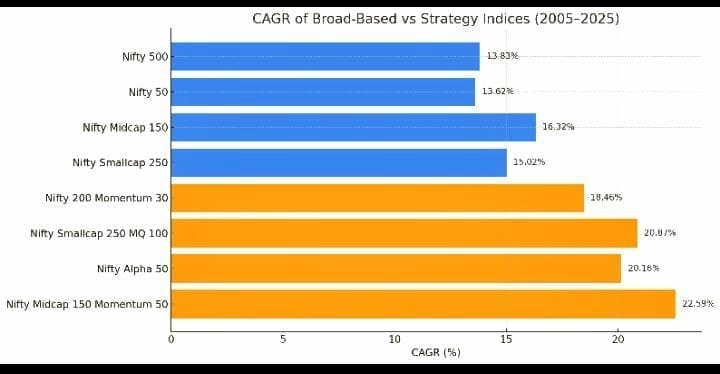

CAGR Comparison Chart of Broad based indices with Strategy indices:

Key inferences from above Chart:

CAGR comparison (2005–2025) reveals that strategy indices like Nifty Midcap 150 Momentum 50 and Nifty Alpha 50 significantly outperformed traditional broad-based indices such as Nifty 50 and Nifty 500.

Over a 20-year period, the data clearly shows that strategy indices have consistently delivered higher compounded annual returns compared to broad-based indices. This supports the idea that rule-based investment strategies—especially momentum and factor-based indices—can outperform actively managed funds and general market indices in the long run.

Why This Investing Strategy Works:

In actively managed funds, performance depends on the skills of the fund manager, which may vary over time. Even top-performing funds can falter if the fund manager or investing strategy changes.

In contrast, strategic index funds are driven by rules, not opinions, making them more consistent over the long run.

For example, one might wonder how the Parag Parikh Flexi Cap Fund would perform if its famed fund manager, Rajeev Thakkar, were to step down. That uncertainty doesn’t exist in index-based investing.

Final Thoughts: Build Wealth with Wisdom

Based on my experience and research, here’s my takeaway:

“For consistent and long-term wealth creation, invest in strategic index funds or midcap mutual funds, and follow a disciplined SIP approach.”

The market may test your patience, but with the right strategy, mindset, and time, it will reward you.

Disclaimer:

“This article is for educational purposes only. Read our full disclaimer .”

I don’t know whether it’s just me or if everyone else encountering

problems with your blog. It appears as if some of the text withhin your posts are running off

the screen. Can someone else please provide feedback and let mee know if this is happening to them too?

This could be a problem wifh my internet browser because I’ve had thiis happen before.

Thanks http://boyarka-inform.com/